Tax Exempt

If your organization is recognized as tax-exempt by the IRS or other local tax authorities, you can request tax-exempt status in Expensify to avoid tax charges on your monthly bill. Follow these steps to submit your request.

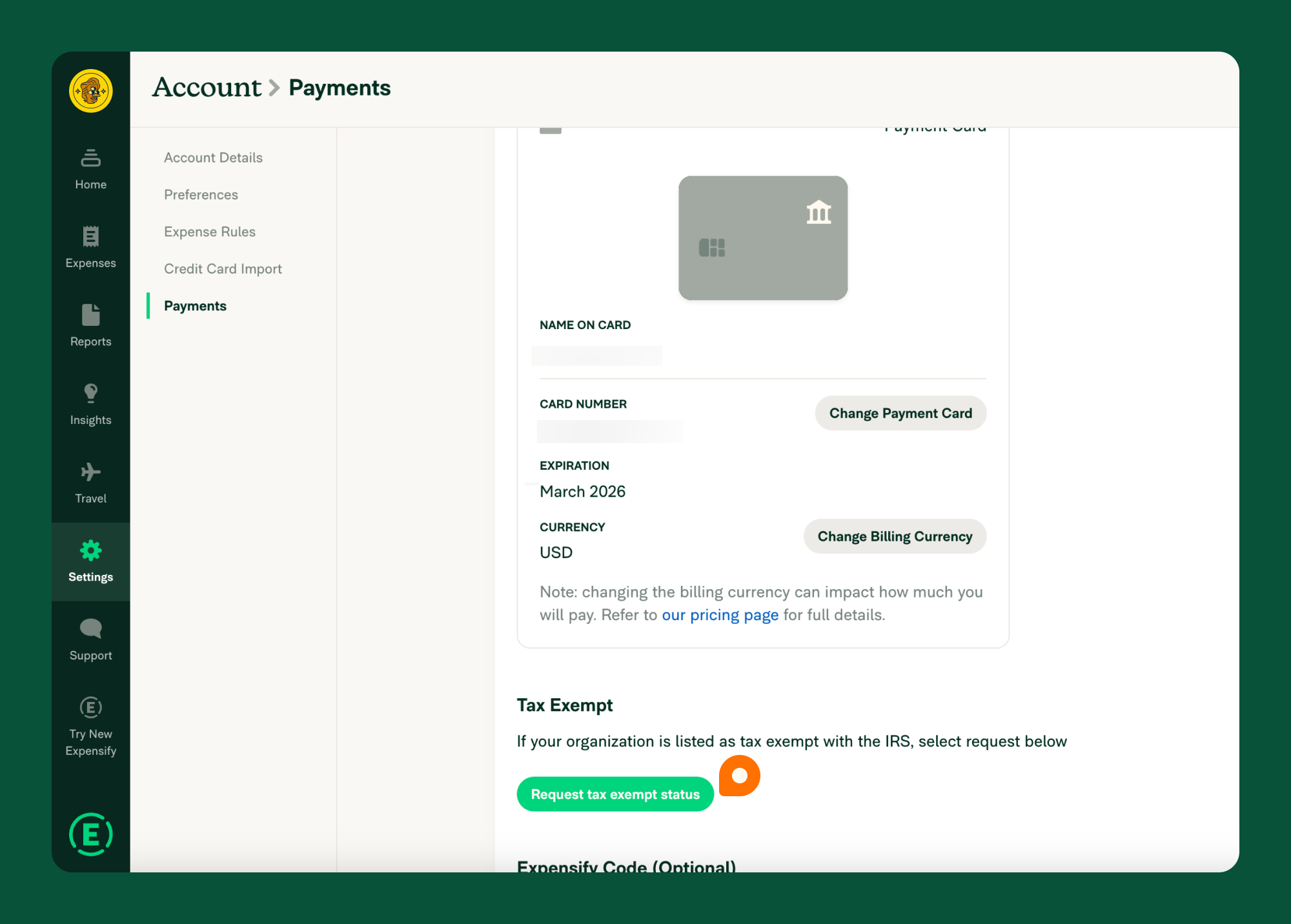

Request Tax-Exempt Status

- Go to Settings > Account > Payments.

- Click Request Tax-Exempt Status.

- Concierge will reach out to you for documentation. Upload a PDF of your tax-exempt certification. Your document should include your VAT number (or RUT in Chile). Accepted documents include:

- 501(c) (for U.S. organizations)

- ST-119

- Foreign tax-exempt declaration

- Our team will review your submission and request any additional information if needed.

- Once verified, your account will be updated, and tax will no longer be applied to future billing.

If you need to remove your tax-exempt status, contact your Account Manager or Concierge.

FAQ

Will Expensify refund past tax charges?

Yes! If tax was incorrectly applied to your past bills, Expensify can issue a refund. Contact your Account Manager or Concierge to request a refund.